Let us help you navigate the dynamic world of third-party risk with solutions to suit your company’s business risk profile.

TDI offers intelligence and analytics to manage risk and compliance within your business and among third parties. We provide compliance officers, risk managers, legal professionals, portfolio managers, and senior executives with the critical information necessary to operate a business with confidence. Our risk-based due diligence, investigations, and TDI Diligence Suite offer programmatic solutions to manage risk with third-party business partners, such as distributors, suppliers, vendors, agents, and clients. We have conducted thousands of third-party due diligence investigations to identify information that could pose compliance, business, or reputational risk to our clients, innovating new investigative and reporting methodologies in response to individualized client requirements.

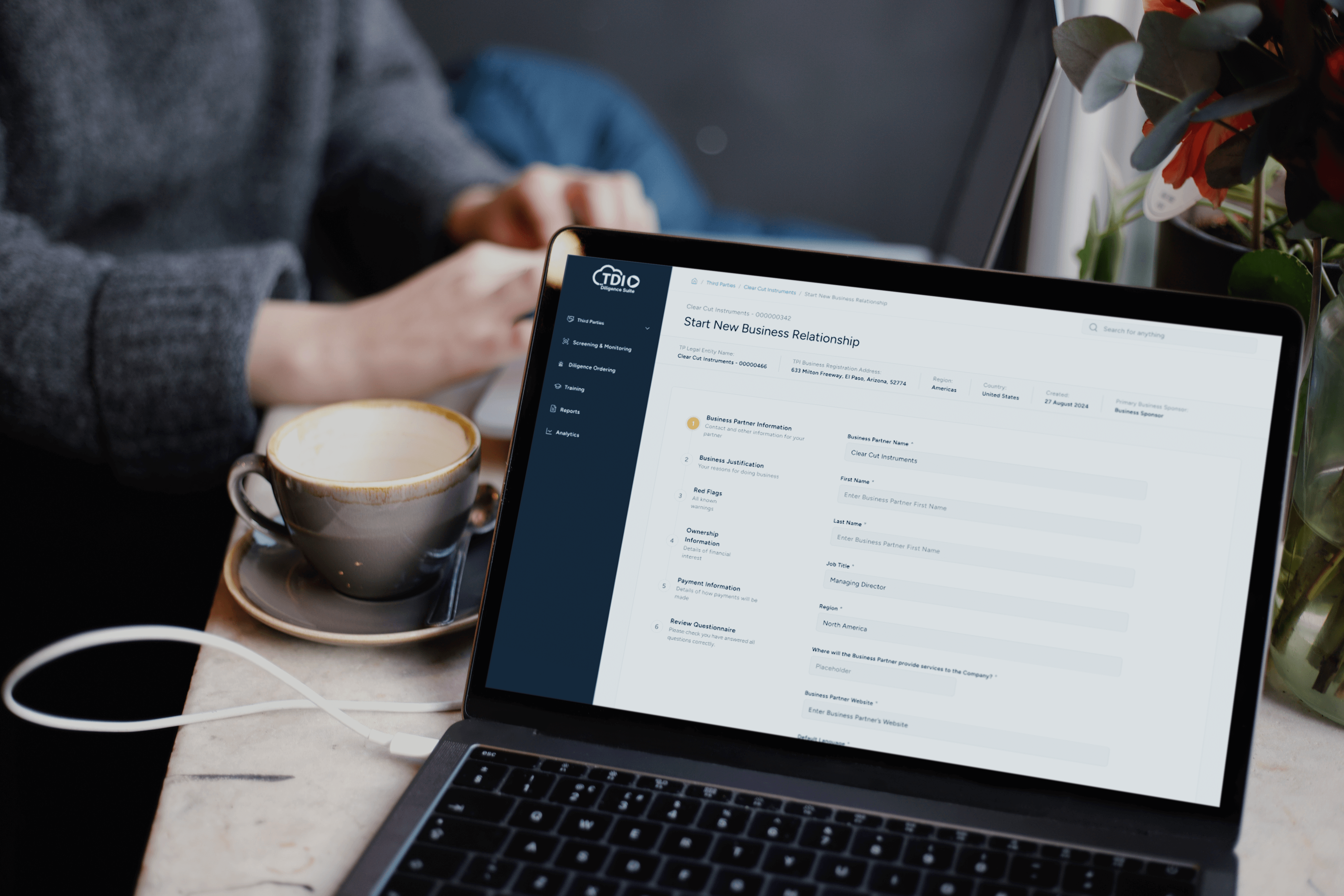

A client-centric approach to third-party risk management

TDI Diligence Suite was built to be configurable to your needs and flexible to grow and change with your compliance program while meeting the increasing requirements of corporate compliance policies and external regulatory authorities. TDI consults with clients on design and implementation, creating risk models and compliance processes that enable risk-based decisions while leveraging disparate data streams. We work with multinational companies to develop processes that work across their businesses, to turn risk indicators into actionable information, and to tailor the platform to meet our clients’ specific business needs. For smaller businesses and compliance teams, we provide a streamlined version of TDI Diligence Suite for rapid implementation with minimal configuration.

The Value of a Third-Party Risk Management System

Scalable Design

TDI Diligence Suite is used daily for thousands of transactions around the world. The system provides an auditable record of all activities associated with onboarding and managing third parties.

Key features include:

- An integrated risk model supporting a variety of risk factors and weightings that can leverage internal and external sources of information as model inputs

- Automated checks of suppliers, distributors, customers, and other third parties against international watch lists, sanctions lists, PEP lists, and adverse media

- Third-party risk monitoring

- Ability to escalate and order additional due diligence from TDI

- Platform support for 35 languages

- Addresses international data privacy requirements such as the General Data Protection Act (GDPR) and data residency regulations

- 256 AES data encryption at rest and in transit

- Integrates with single sign-on (SSO), ERP, CRM, HRIS, and most other enterprise systems

- Configurable approval workflows supporting serial and parallel approval processes

- Ability to control the location of the server by region (Americas; Europe, Middle East, and Africa; Asia-Pacific)

Configurable risk model & data streams

TDI Diligence Suite includes an integrated risk model to support a variety of risk factors and weightings. For jurisdictional risk factors, we incorporate indices such as Transparency International’s Corruption Perception Index (CPI). For risk factors that require input from business sponsors or third parties, we automatically pull relevant information from due diligence questionnaires and forms into the model. Integration with other data sources can also be leveraged to add additional risk factors to a client’s model.

Our ability to consult with clients in developing new or refining existing risk models differentiates our overall approach.

Secure, Robust Platform

TDI Diligence Suite is powered by Salesforce, a leader in the cloud-service industry. Security features include:

- Secure data centers with 24-hour manned security, biometric scanning access, concrete-walled data center rooms, computing equipment in access-controlled steel cages, video surveillance throughout the facility and perimeter, and buildings engineered for local seismic, storm, and flood risks.

- Connection to the environment via TLS cryptographic protocols using global step-up certificates to establish a secure connection from browsers to TDI Diligence Suite.

- Network protection via perimeter firewalls, edge routers blocking unused protocols, and internal firewalls that segregate traffic between the application and database tiers.

Nth Party Relationship Management

Different business units within a company may be working with the same customer, supplier, or sub-supplier, possibly engaging them for a completely different service. TDI Diligence Suite supports the transparency of an organization’s universe of third parties and sub-third parties while reconciling risk at the business unit level. Our system can leverage the data that one business unit may have on a third party and connect risk with sub-third parties. This multi-tier capability saves time and money by avoiding duplication of effort, while also offering deeper insight into the full universe of third-party relationships.

Beyond The Third Party: Navigating Nth Party Risk

Relationship Manager

The Relationship Manager is a fully configurable end-to-end workflow management platform specifically designed to help clients manage third-party risk. This application creates an auditable record of the entire process, provides valuable and easy-to-understand insight into your enterprise risk, and addresses data privacy requirements.

Screening & Monitoring

TDI Diligence Suite enables clients to enter third parties directly into the system via automated forms configured to capture client-defined information. Third parties are automatically pulled from completed questionnaires and screened in real time with an intuitive approach for reviewing and determining the validity of screening results. Third parties can also be tagged for ongoing daily monitoring.

Diligence Ordering

The Diligence Ordering application allows users to order, manage, and report on due diligence investigations requested of TDI’s team of professional analysts.

Trusted advice for your most complex problems

TDI combines deep expertise and industry-leading software to help clients successfully manage risk. Contact us to find out more.